Bridging Banks and Customers

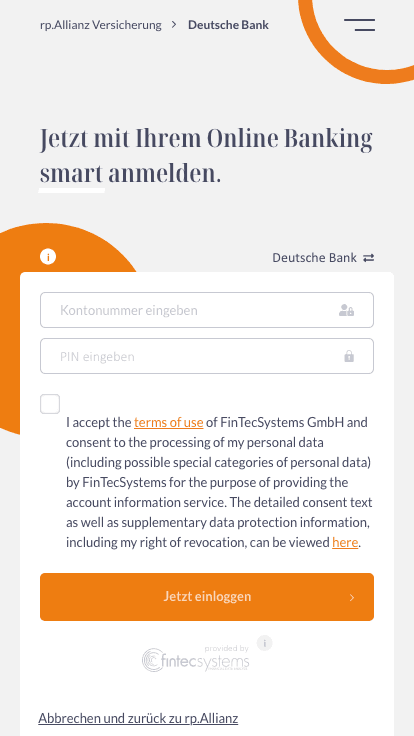

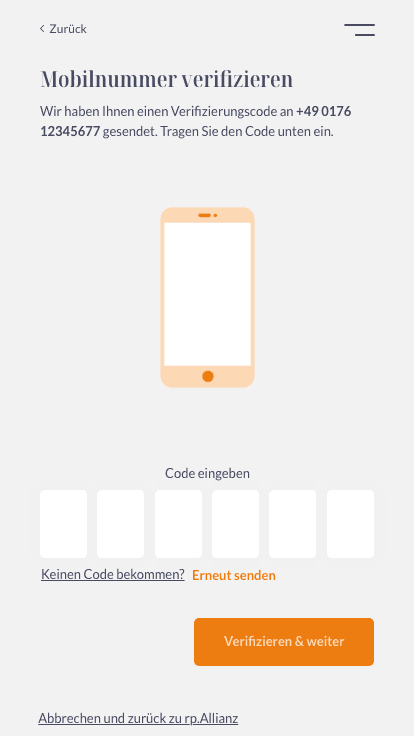

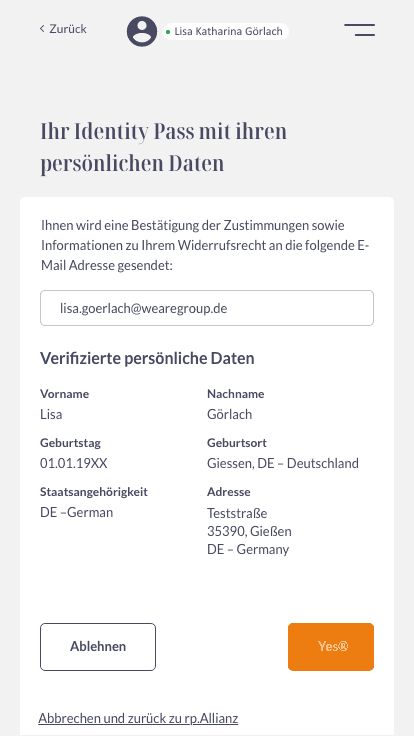

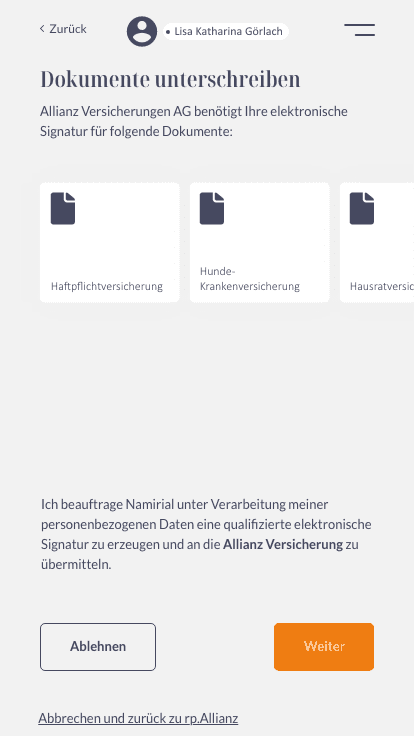

In August 2020, WeAreGroup GmbH and CRIF AG launched the Third-Party-Provider Plus (TPP+) platform, connecting 220 German banks to the yes® ecosystem. This initiative enables customers to verify their identity online, sign contracts, log in, and make payments using their bank accounts.

CRIF AG

Services:

UI/UX, Development, Managed Service, Support

Date:

August 2020 - December 2023

Revolutionizing Online Banking: 220 Banks Now Seamlessly Connected to yes® Ecosystem

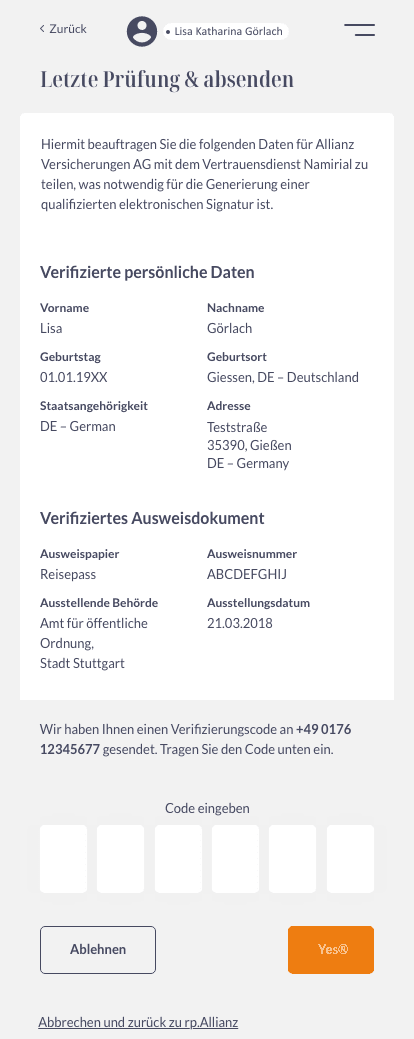

The partnership between WeAreGroup GmbH and CRIF AG is transforming the future of digital banking in Germany with the launch of the Third-Party-Provider Plus (TPP+) platform. This cutting-edge solution connects 220 banks to the yes® ecosystem, enabling customers to effortlessly verify their identity, sign contracts, and complete payments directly through their bank accounts. What began as a service exclusive to Volksbanken and Sparkassen has now expanded to include banks across the country, creating a unified, seamless experience for millions of users. This initiative not only simplifies digital interactions but also strengthens trust and security in online banking, setting a new benchmark for convenience and efficiency in the financial sector.

The success of the TPP+ platform is driven by several key factors. Its scalability and reach have allowed it to grow from serving a limited group of banks to encompassing the entire German banking landscape. By integrating multiple services—such as identity verification, contract management, and payments—into a single, user-friendly interface, the platform enhances convenience and fosters widespread adoption. The strong collaboration between WeAreGroup and CRIF AG has been instrumental in ensuring a smooth rollout, combining their expertise to drive innovation and operational excellence. Additionally, the emphasis on security and trust, achieved through partnerships with well-established banks, reassures users and promotes confidence in the system. As demand for digital banking solutions continues to rise, the TPP+ platform stands out by meeting these needs with a secure, scalable, and customer-focused solution.